Real Estate Market Report: 2025 Q2

Let’s talk about the second quarter of 2025 in the Whistler and Pemberton real estate markets.

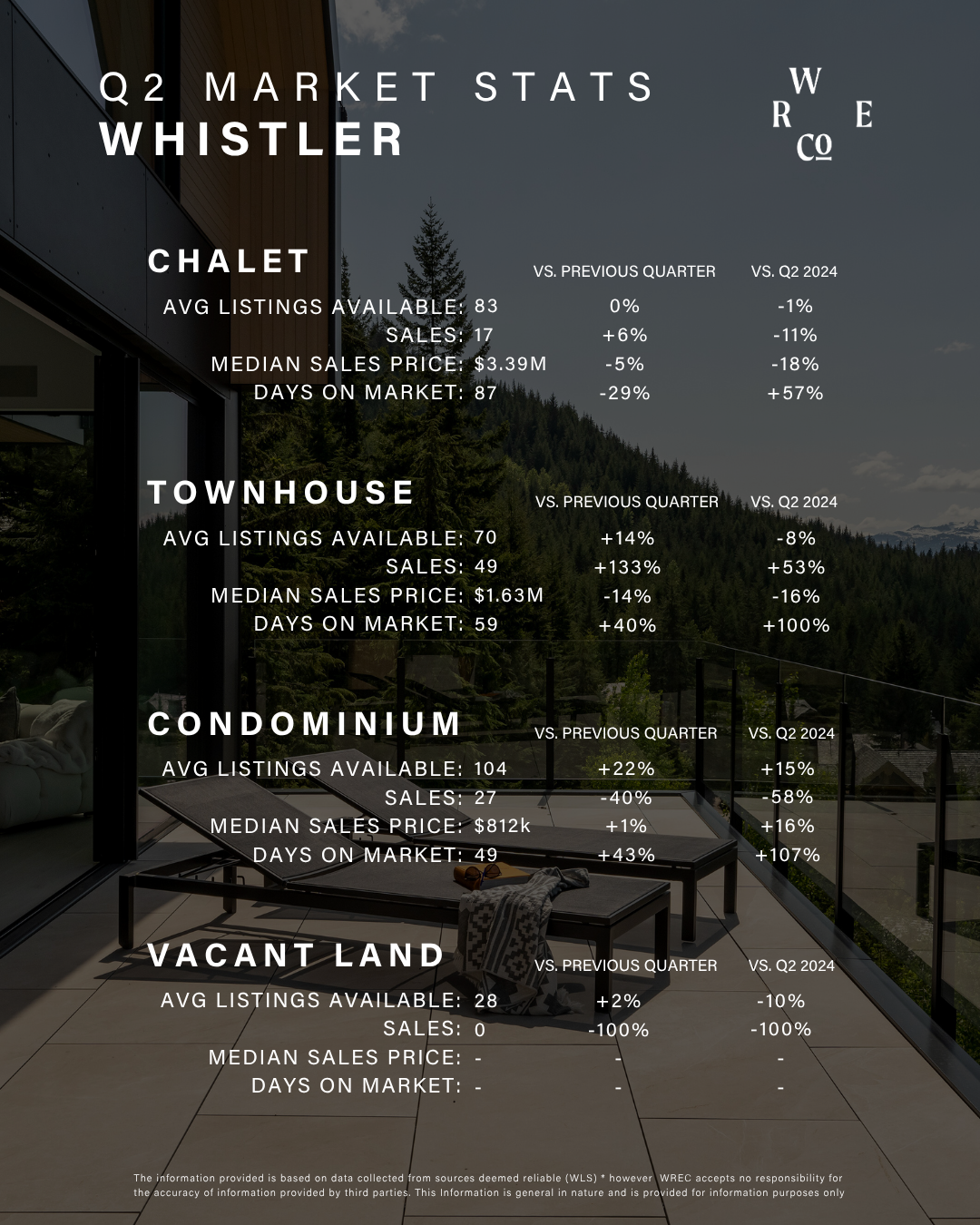

Whistler

The Whistler real estate market continued its slower pace into the second quarter of 2025, with 111* total sales, marking a slight decline from Q1 and approximately 20% fewer sales year-to-date compared to mid-2024. May emerged as the busiest month of the year thus far, accounting for over 40% of the quarter’s activity. The luxury segment (sales over $4M) remained active, with 8 of the 17 year-to-date luxury sales occurring in Q2. There were 53% more townhome sales and 60% fewer condo sales than in the same period last year. Overall, the median sale price for the market in May and June was at its highest since July 2024. However, properties took longer to sell across all categories compared to the same period last year. Single-family homes had a median of 87 days on market, up 60%, while condos and townhomes doubled their median days to sell, reaching 49 and 59 days, respectively. Inventory levels remained relatively stable, with an average of 337 active listings* throughout the quarter—a slight decrease from the same period last year. Year-to-date buyer origin remained consistent with historical trends. 67% of purchasers were from Whistler, Vancouver, or the North Shore, with another 18% from the rest of BC. International buyers made up 12% of the market, three-quarters of whom were from the U.S.

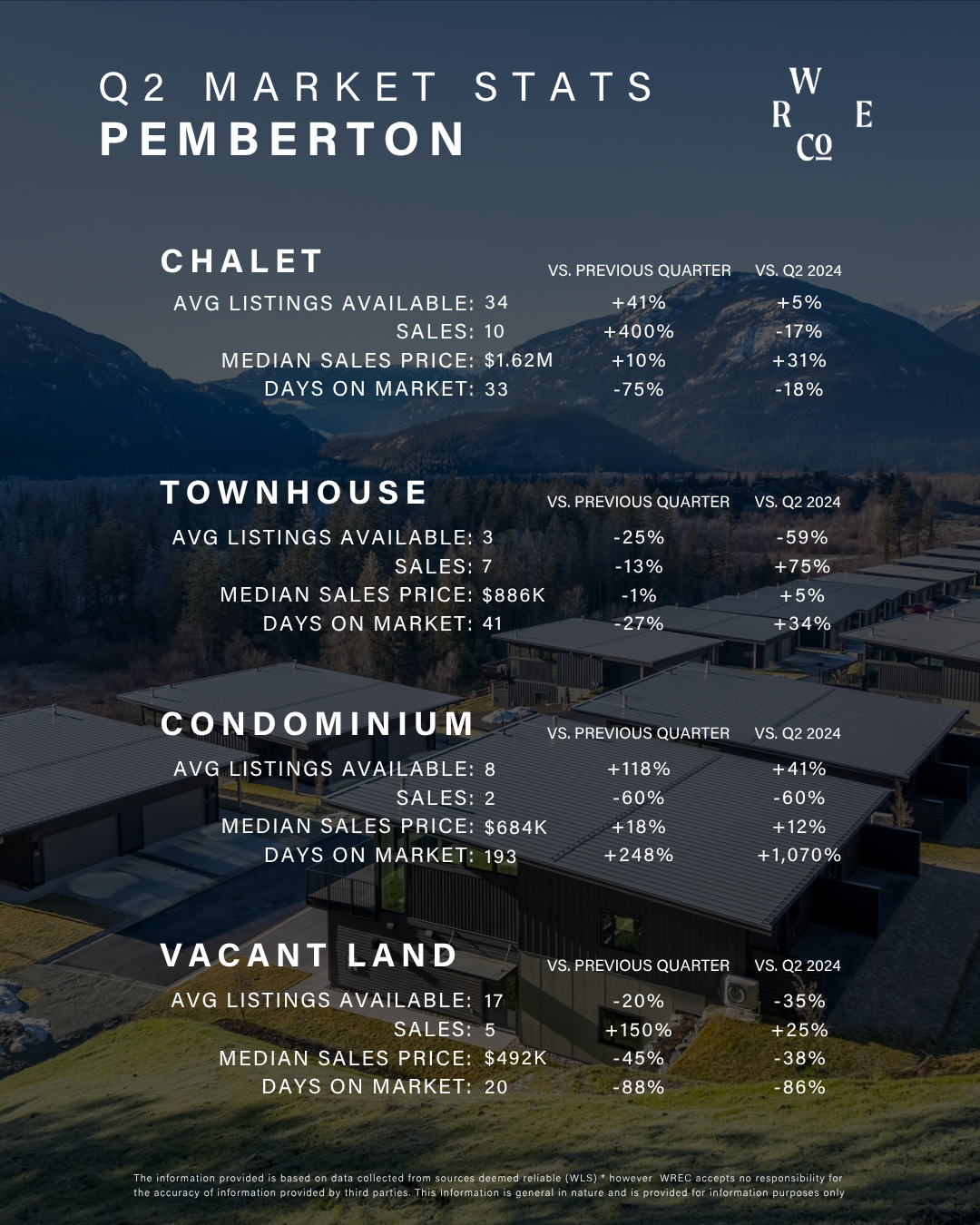

Pemberton

Pemberton maintained steady momentum in Q2, posting 25*sales, up from 20* in Q1, though down from 32* in Q2 2024. Overall, year-to-date sales are 12% behind last year’s pace at this point. Of note in Q2 was the increase in single-family home sales, rising to 10 from just 2 in Q1—likely reflecting improved buyer confidence following some stability in interest rates. Median sale prices were also up year-over-year for single family homes (+31%), townhomes (+5%) and condos (+12%). The luxury segment saw renewed activity late in the quarter, with all three of Pemberton’s $2M+ sales for the year occurring in May and June. Inventory climbed 20% throughout the quarter, ending with 73* active listings, or 57* when excluding vacant land. This marks the highest inventory level seen in a year, providing more options for buyers moving into the second half of 2025. Time on market showed mixed results, as single-family homes sold faster, with a median of 33 days on market, lower versus both last quarter and last year, while condos and townhomes took longer to sell, year-over-year. Buyer origin has remained typical for the region so far this year, with 70% of purchasers from Whistler or Pemberton, 26% from elsewhere in BC, and 4% from outside the province, including 2% international buyers.

As we move into the second half of 2025, we anticipate a gradual increase in the pace of sales in the Whistler market, while Pemberton is expected to maintain its steady momentum. With pricing expected to remain stable across both regions, market conditions appear favourable for buyers and sellers who are well-informed and prepared to act. While inventory levels have improved and properties are taking longer to sell compared to recent years, this shift offers greater opportunity for buyers to explore options and negotiate strategically. At the same time, sellers who price their properties competitively and respond to current market conditions are well-positioned to achieve successful outcomes. Although a degree of “wait and see” remains evident among buyers, there are meaningful opportunities for those willing to engage. From a broader economic perspective, ongoing uncertainty around tariffs continues to influence sentiment. However, the Bank of Canada’s decision to hold interest rates steady, with expectations for continued stability through year-end, has helped foster renewed buyer confidence in both the Whistler and Pemberton markets.

*excluding parking stalls

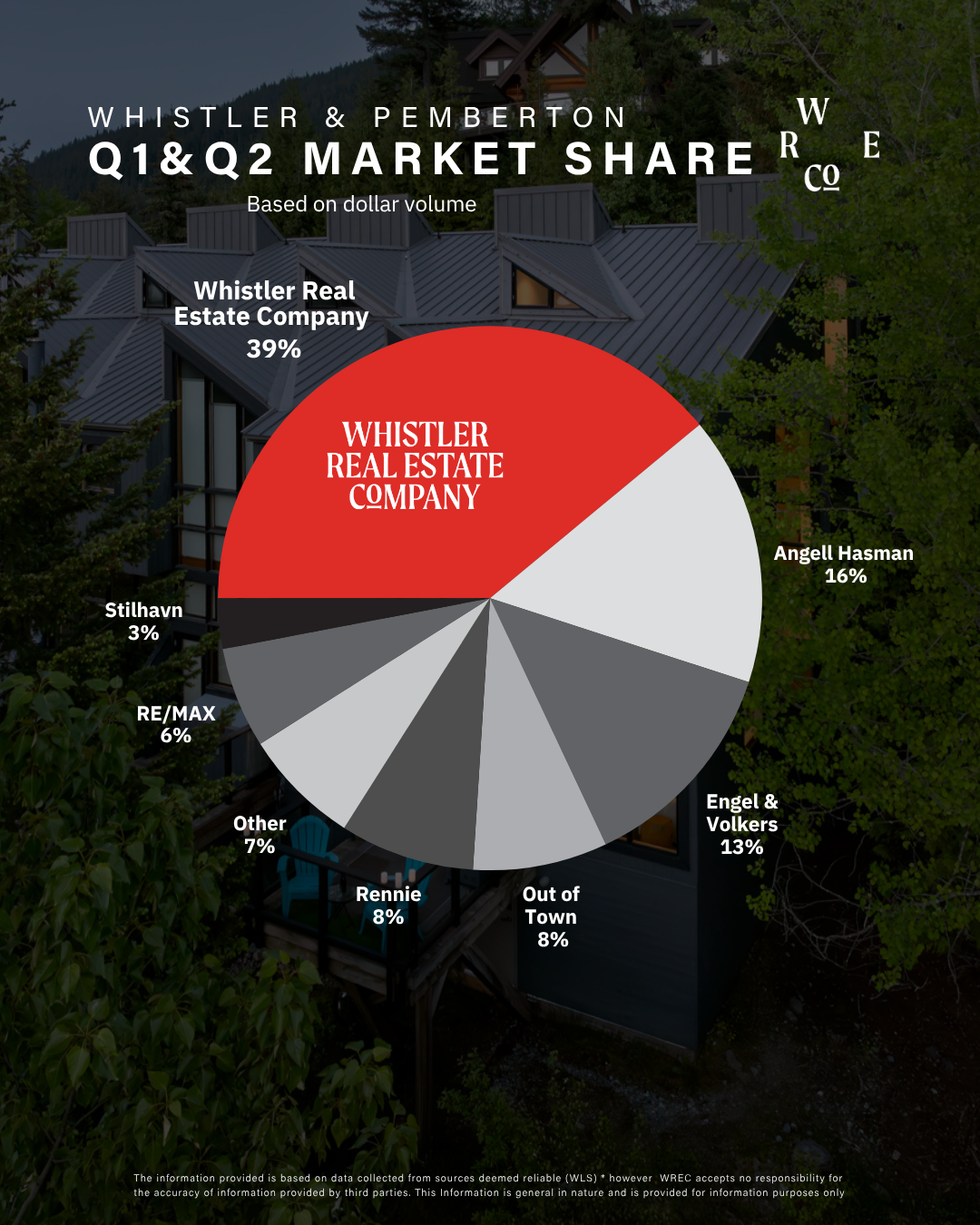

Market Share

Whistler Real Estate Company agents represented 39% of the Whistler and Pemberton market in the first half of 2025 and helped our clients achieve amazing outcomes.

Regulatory Notes

Foreign Buyers Ban

As previously noted, the Foreign Buyer Ban does not apply to the Whistler or Pemberton markets, nor does the Foreign Buyer Tax.

Underused Housing Tax

The Underused Housing Tax (UHT) is an annual 1% tax on residential property owned by non-resident, non-Canadians that is deemed to be vacant or underused by the Canada Revenue Agency (CRA). There are situations, however, where the tax or reporting obligations could apply to Canadian citizens or residents, so it is important to understand whether you are an excluded or affected owner based on your specific situation. We recommend that you talk to your accountant about how it may impact you and your Whistler or Pemberton property.

Small-Scale Multi Unit Housing

The provincial government has introduced new housing legislation to update zoning rules to deliver more small-scale, multi-unit (SSMU) housing, with the intended objective of building more homes faster. In most municipalities of more than 5,000 people, these changes can allow for 3-4 units permitted on lots currently zoned for single-family or duplex use, depending on lot size, however strata bylaws may impact this. Get in touch with your local Whistler Real Estate Company agent to learn more about how this may impact your Whistler or Pemberton property or property of interest.

BC Home Flipping Tax

Effective January 1, 2025, British Columbia’s new home-flipping tax aims to limit short-term real estate practices and improve housing affordability. The tax applies to properties sold within two years of purchase, with a 20% rate on net taxable income for sales within the first year, and decreasing tax rates for sales between one and two years. Exemptions are subject to specific conditions and filing requirements. For more information, get in touch with your local Whistler Real Estate Company agent to better understand how this affects your property.

Capital Gains Inclusion Rate

In March 2025, the Government of Canada announced the cancellation of the capital gains inclusion rate hike, maintaining the current inclusion rate. This decision reflects the government’s commitment to fostering a stable and favourable environment for investment and economic growth.