Real Estate Market Report: 2025 Year End

Let’s talk about the Whistler and Pemberton real estate markets in 2025.

Whistler

When looking at the year in totality, sales data shows that unit sales were down slightly, and total dollar volume declined marginally when compared to 2024. This market decline was almost exclusively concentrated in the condominium segment. Condo unit sales were down 17% year over year, while dollar volume decreased by 12%. These declines were partially offset by gains in other property types. Chalet sales increased by 7% in unit sales and 11% in dollar volume, while townhouse sales rose by 15% in units and 9% in dollar volume. Overall, the market was down 6% in total units sold, but only 1% in dollar volume, reflecting the higher price points of chalets and townhouses. Total listing volume was also down from 2024. However, of the new listings that entered the market, 53% sold within the year. If condos and vacant land are excluded, that figure rises to over 60%, indicating that buyers were actively engaged when the right product was available.

Looking ahead in Whistler, the chalet and townhouse markets showed recovery this year, with sales increasing and average prices remaining steady. We anticipate these segments will continue to remain stable, while the condo market is expected to see a rebound as we move into 2026.

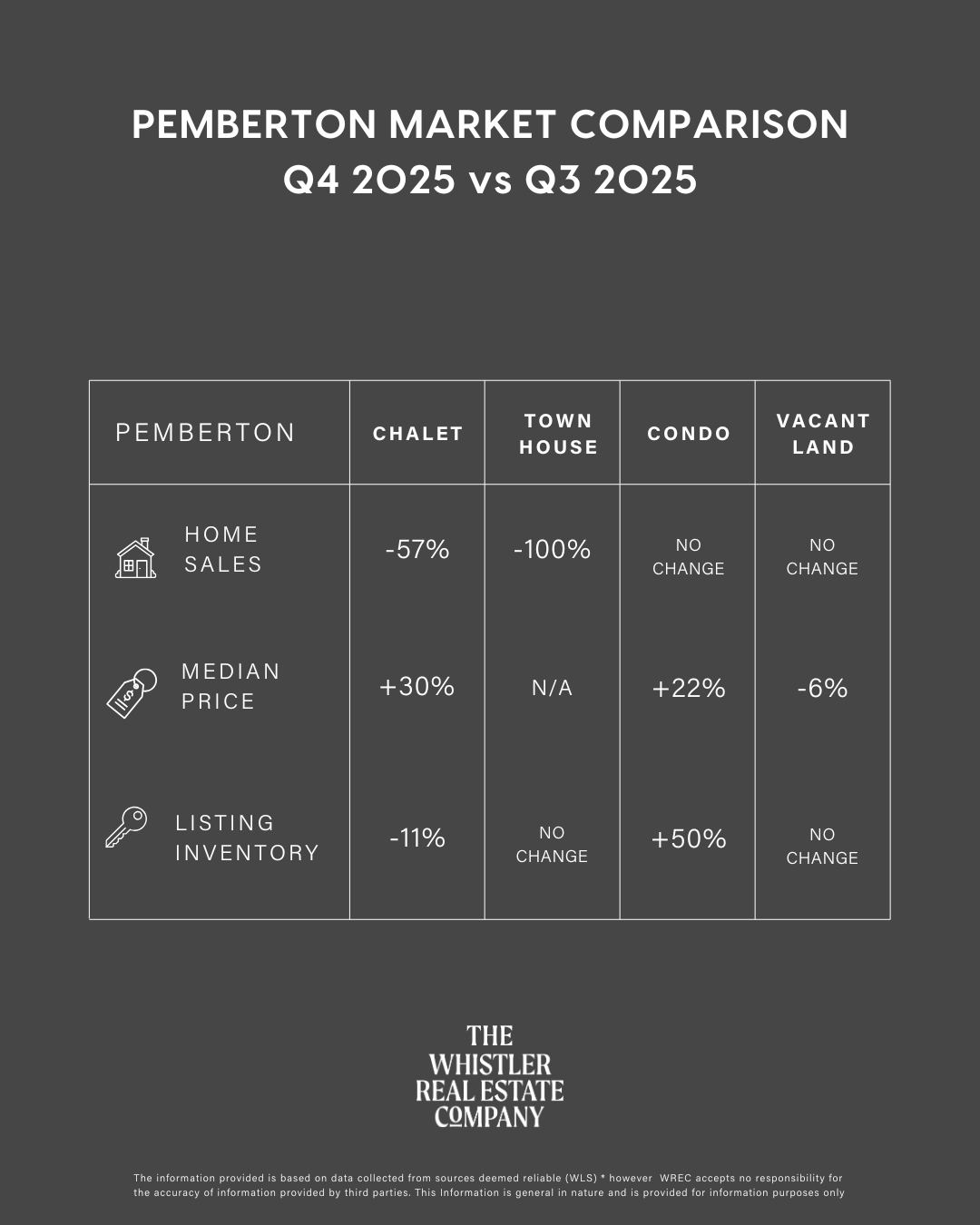

Pemberton

When breaking down sales and dollar volume in Pemberton, the relatively small size of the market can make data analysis particularly nuanced. Total sales volume declined across all major housing types, with the exception of townhomes, which maintained consistent levels in both unit sales and dollar volume. Chalet sales were down 8% in terms of units sold but were up slightly by 1% in dollar volume. Notably, chalets with acreage recorded the most expensive sale ever for this housing type. Townhome sales remained unchanged year over year, with the exact same number of transactions and consistent dollar volume. Condominium sales were sluggish, with both unit sales and dollar volume declining year over year. A total of 195 new properties entered the market during the year, closely mirroring 2024, which saw 194 new listings.

Interest rates, broader economic conditions, and buyer confidence will be key factors influencing the market as we move through 2026. Economists are suggesting that the Bank of Canada will hold interest rates at their current levels at least through the first half of the year. This may signal to buyers who have taken a wait-and-see approach that now could be an opportune time to move forward, particularly as home prices remain stable. In the United States, interest rate reductions may occur, as the Federal Reserve faces increasing pressure to begin easing rates. This could strengthen the Canadian dollar and act as a catalyst for U.S. and foreign buyers who are not subject to the Canadian government’s foreign buyer ban in Whistler and Pemberton. For these buyers, current conditions may present an opportunity to secure greater value for their dollar.

*excluding parking stalls

Market Share

Whistler Real Estate Company agents represented 35% of the Whistler and Pemberton market in 2025 and helped our clients achieve amazing outcomes.

That’s it for our year end recap. For more information about the market or if you are looking to buy or sell, contact your local Whistler Real Estate Company agent. The Whistler Real Estate Company has been the leading brokerage in Whistler since 1978* and we thank our clients for making us number one again in 2025. Cheers to 2026!

*Based on statistics taken from the Whistler Listings Systems (WLS) from 1978 – to date

Regulatory Notes

Foreign Buyers Ban

As previously noted, the Foreign Buyer Ban does not apply to the Whistler or Pemberton markets, nor does the Foreign Buyer Tax.

Underused Housing Tax

The Underused Housing Tax (UHT) is an annual 1% tax on residential property owned by non-resident, non-Canadians that is deemed to be vacant or underused by the Canada Revenue Agency (CRA). There are situations, however, where the tax or reporting obligations could apply to Canadian citizens or residents, so it is important to understand whether you are an excluded or affected owner based on your specific situation. We recommend that you talk to your accountant about how it may impact you and your Whistler or Pemberton property.

Residential Tenancy Act Changes

On July 18, 2024 there were significant changes to the Residential Tenancy Act that those who own or are looking to sell or purchase tenant occupied properties should be aware of. Some of the key changes include:

- Mandatory landlord use of a new web portal to generate Notices to End Tenancy for personal or caretaker use

- Extended notice period

- The individual moving into the property must occupy it for at least 12 months

It is strongly advised that you seek legal advice to navigate these new regulations effectively if you plan to proceed with a transaction involving tenant-occupied property to ensure compliance with the new rules and ensuring understanding of rights and obligations of the parties involved. More information regarding these changes can be found on the BC Government Website.

Small-Scale Multi Unit Housing

The provincial government has introduced new housing legislation to update zoning rules to deliver more small-scale, multi-unit (SSMU) housing, with the intended objective of building more homes faster. In most municipalities of more than 5,000 people, these changes can allow for 3-4 units permitted on lots currently zoned for single-family or duplex use, depending on lot size, however strata bylaws may impact this. Get in touch with your local Whistler Real Estate Company agent to learn more about how this may impact your Whistler or Pemberton property or property of interest.

BC Home Flipping Tax

As of January 1, 2025, the BC Home Flipping Tax has come into effect. Please note, this provincial tax is distinct from the existing Federal Property Flipping Tax and specifically targets short-term property sales. Some of the details include:

- The tax applies to income from sales of residential properties, presale contracts, or assignments owned for less than two years

- The rate starts at 20% for sales within 365 days of ownership, decreasing to 0% at 730 days

- This tax applies to any person or entity (individual, corporation, partnership, or trust) selling property within BC, regardless of residency

- Exemptions include certain primary residences

To review all the details, please visit the BC Government Website, as well as the BC Real Estate Association website for a breakdown of the new tax, as well as a comparison with the current Federal Flipping Tax.