Real Estate Market Report: 2023 Q3

Let’s talk about the third quarter of 2023 in the Whistler and Pemberton real estate markets.

The third quarter in Whistler and Pemberton consisted of steady sales, with some exceptional transactions boosting the luxury market segment. The consistent pace, while slightly lower sales activity, is due to the continued questions about interest rates and future Bank of Canada policies. Listing inventory has continued its slow upward progression. This could also be due in part to the end of the summer season, but it does afford buyers more options and opportunities to choose from.

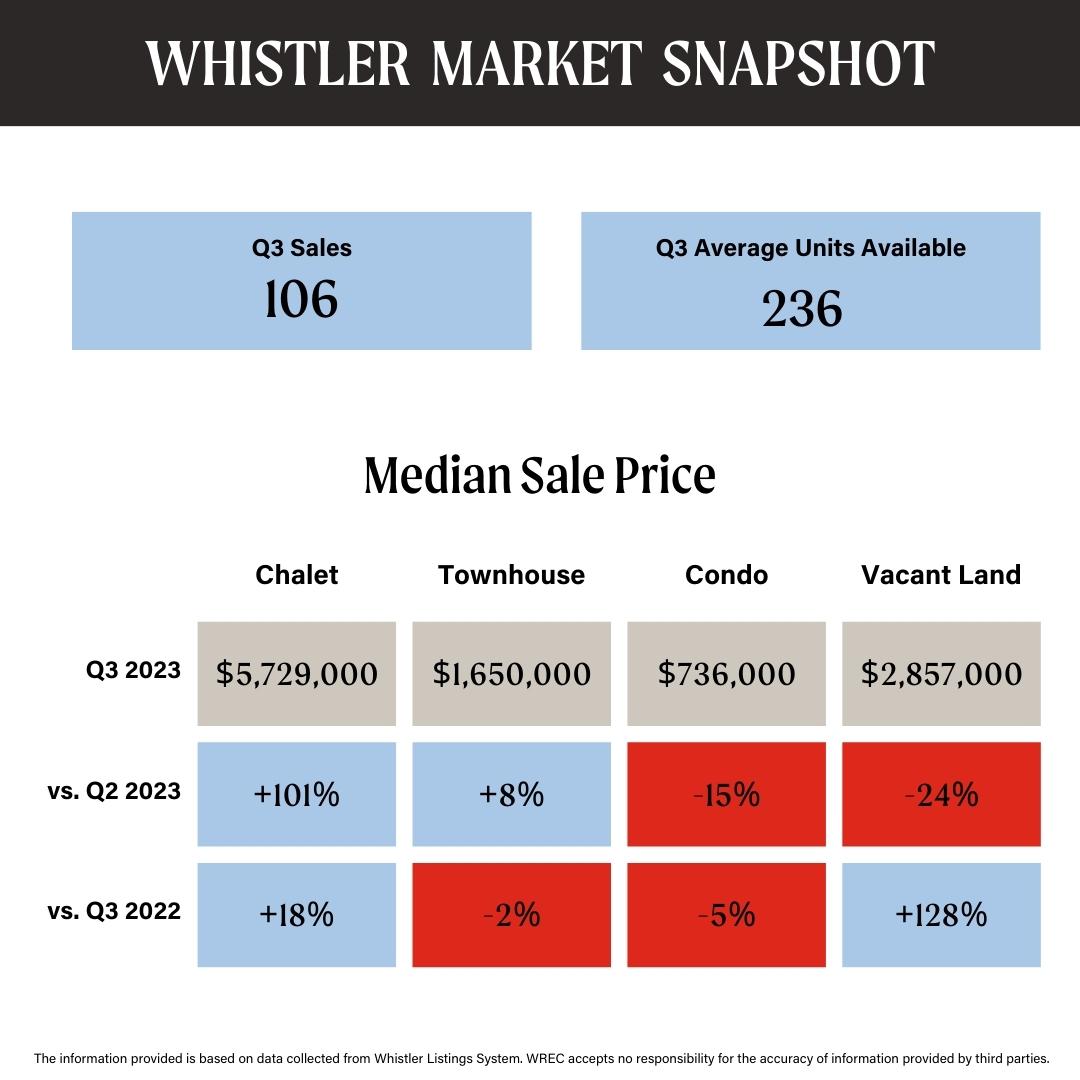

Whistler Real Estate Market

In Whistler, there were a total of 106* sales in Q3. This was down from Q2 but up compared to Q3 in 2022. Sales activity was lower than anticipated, likely due to buyers’ hesitation in predicting future interest rate trends. Nonetheless, significant sales were observed across all market segments, particularly in the luxury segment with 10 sales over $5M in Q3. Most notably, this quarter saw Whistler’s highest-priced home sale in the history of the resort at $32M, instilling confidence in the Whistler market. Looking ahead to Q4, we anticipate buyers taking advantage of increased inventory to secure properties for the upcoming ski season.

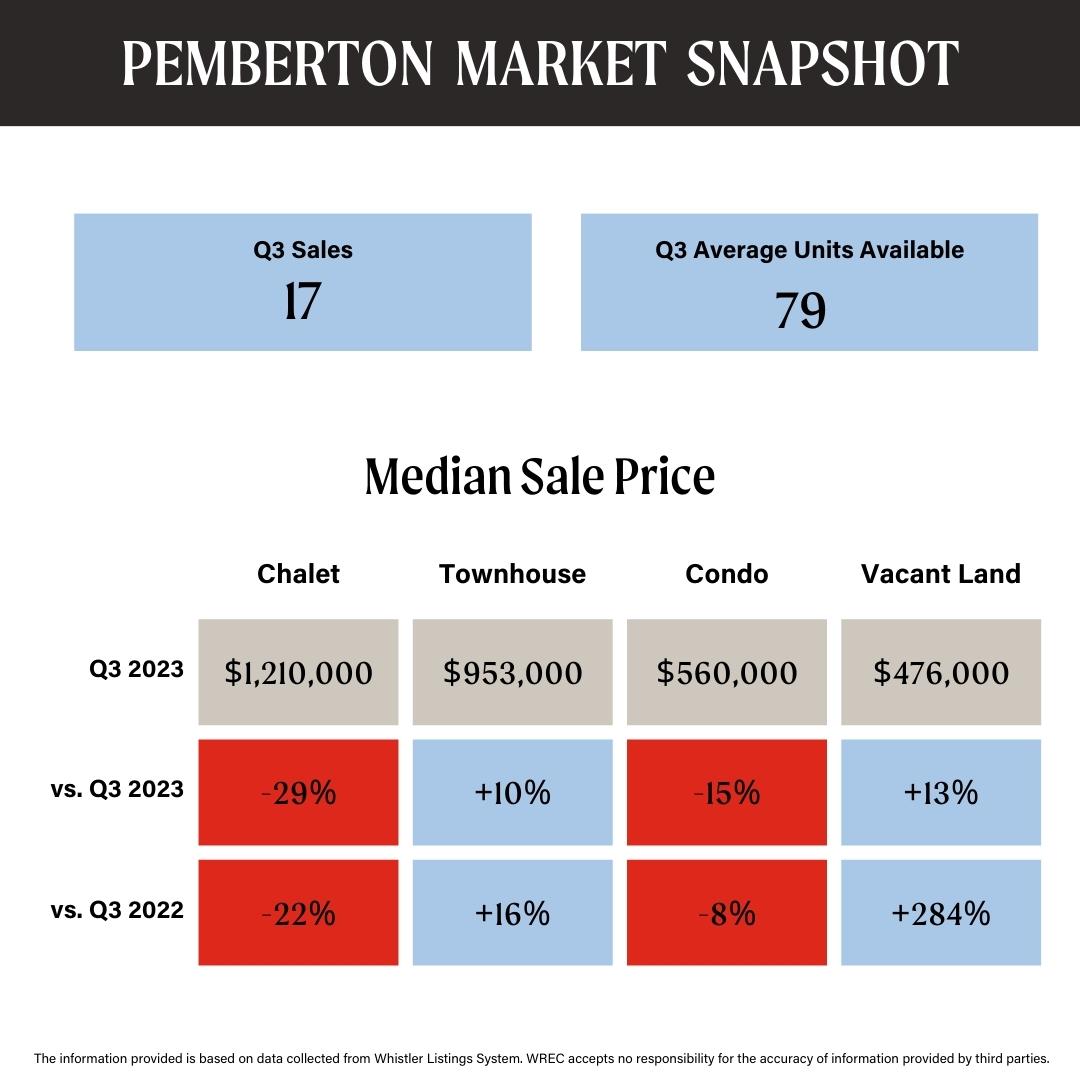

Pemberton Real Estate Market

In Pemberton, there were a total of 17* sales in Q3, indicating a decline in sales volume from Q2. Similar to Whistler, this decline can be attributed to the rate increases and uncertainties regarding future rate adjustments. It’s worth noting that unit sales in Pemberton across all categories (chalet, condominium, townhouse, vacant land) for the entire year of 2022 were matched, even with a slight summer slowdown. Median prices have either remained steady or increased, depending on the category. Inventory levels have improved from rock-bottom levels, providing buyers with a few more options in Pemberton. We expect Pemberton’s market to maintain its steady sales throughout the fall and winter due to limited inventory and available properties at Whistler’s price points.

*excluding parking stalls