Real Estate Market Report: 2024 Q3

Let’s talk about the third quarter of 2024 in the Whistler and Pemberton real estate markets.

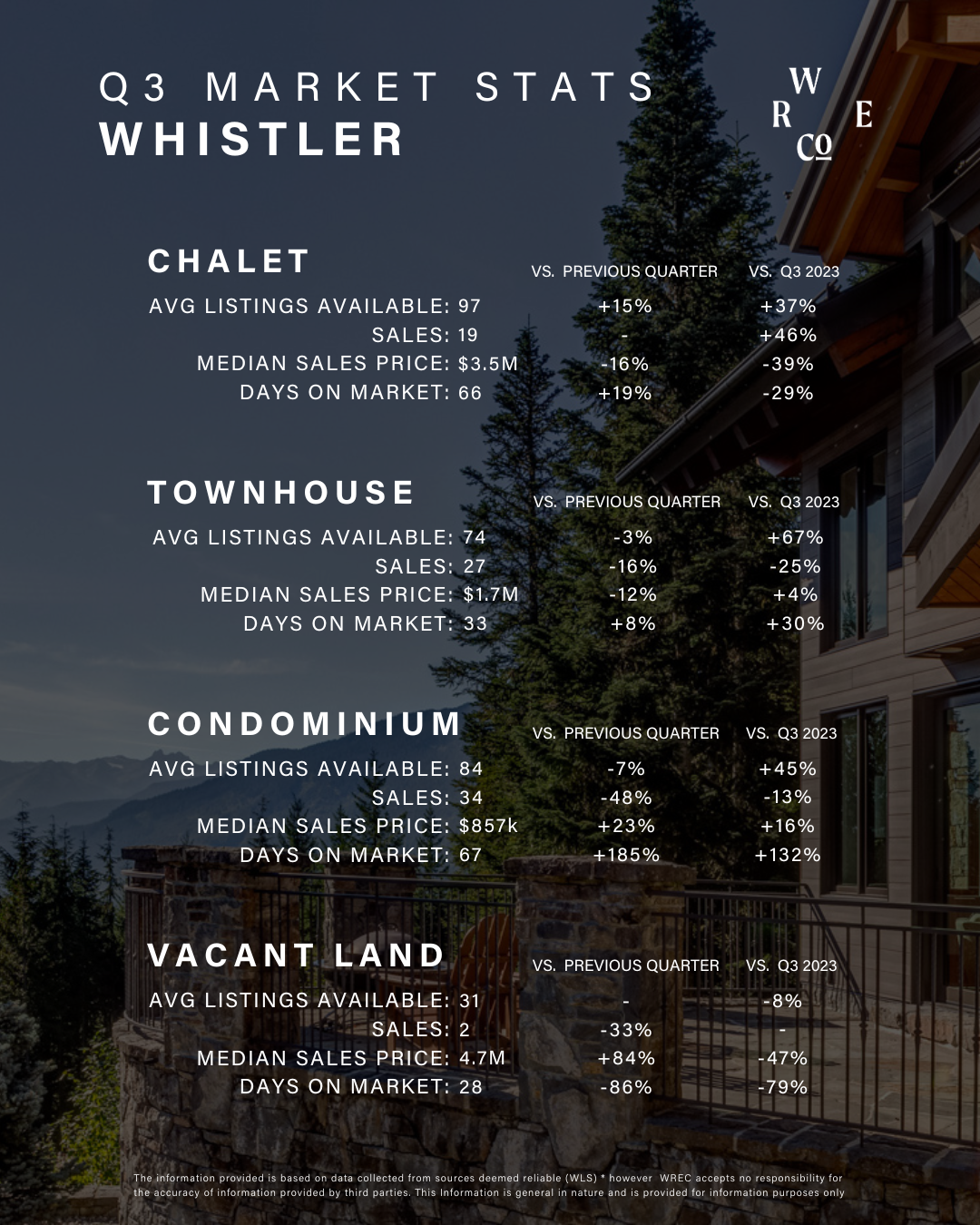

Whistler

Despite a typical slow summer of sales, inventory levels declined slightly throughout the quarter. This came as a function of an almost 40% reduction in the number of listings coming to the market in Q3 vs Q2 (Note: there was a flurry of new listings that in the market back in April and May as a result of the capital gains changes that quickly slowed following the June 25 effective date). In Whistler, there were a total of 104 sales in Q3 spread fairly equally across July, August and a slight pick up in September. This was a 44% decline from the previous quarter, and a 4% decline when compared to the same quarter last year. The luxury segment also slowed down a bit in Q3 with 7 sales over $4M in Whistler and a top sale of $8.7M. Year-to-date buyers origin remains fairly typical, with 81% of purchasers from BC, and a slight increase in the number of US based buyers from 8% at the end of Q2 up to 10% on the year. Market inventory is currently sitting 20% above inventory at this time last year and 25% above the 5-year average. Overall, Q3 market conditions in Whistler leaned in favour of buyers.

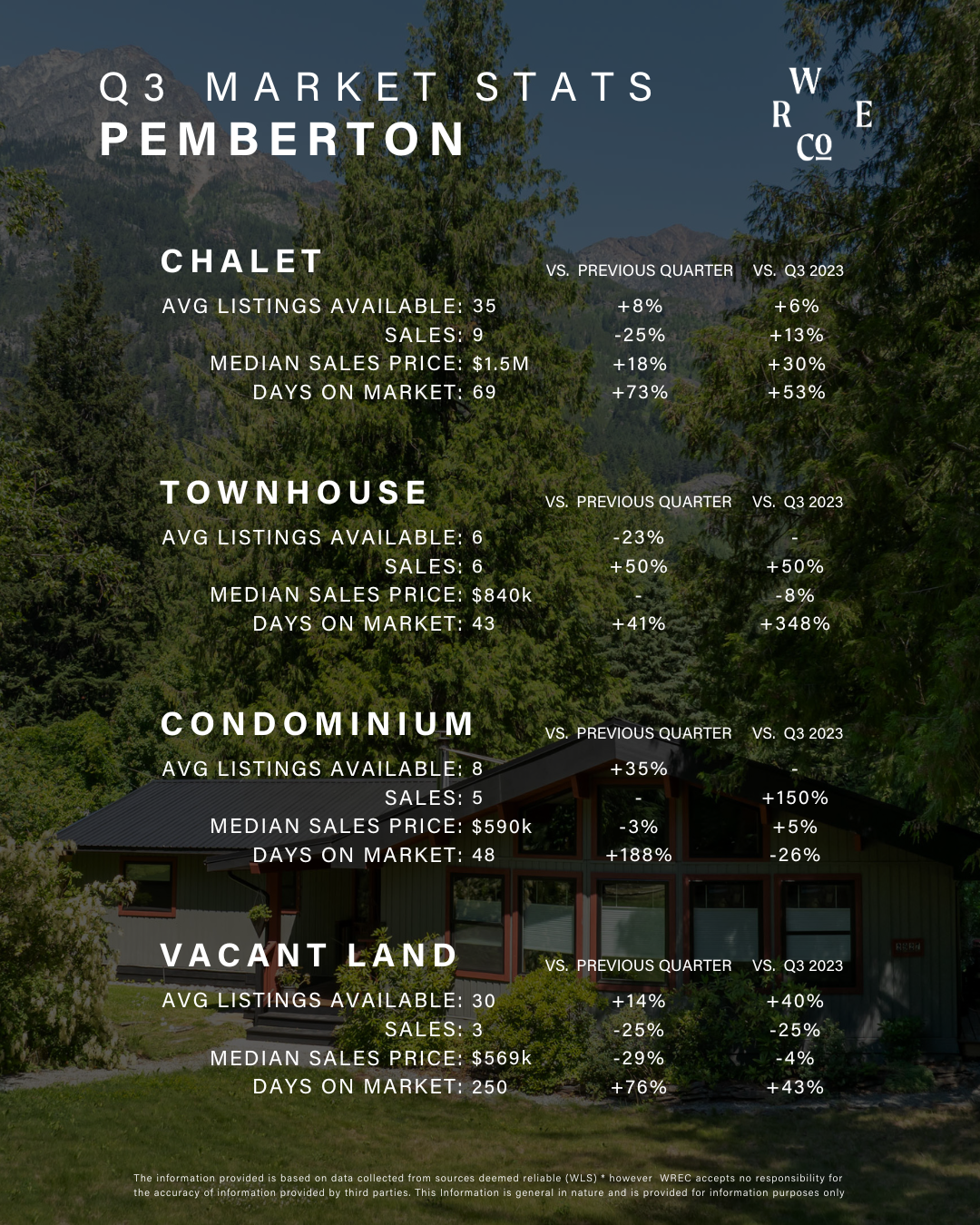

Pemberton

Both sales and inventory levels remained relatively steady in Pemberton throughout the quarter, with a slight slowdown in sales in September. There was a total of 27* sales in Q3, which was a 16% decline from Q2 sales volume but a 50% increase from Q3 of last year. This is likely a result of the three consecutive interest rate decreases we have seen since June along with the mounting consumer confidence that rates will continue to decrease throughout the end of the year and into next. There were 2 luxury sales in Pemberton over $2M, both of which came in August. Market inventory currently sits at 88 units, which is an overall 6% increase in inventory from the same time last year. However, when excluding vacant lots, inventory has actually decreased slightly versus September of last year. So far this year, Pemberton has seen 73% of buyers originating from either Whistler or Pemberton, and an additional 21% of buyers coming from the Lower Mainland and the remainder of BC. Overall, the Pemberton market also leaned in favour of buyers in Q3.

In the last quarter of 2024, we expect to see a pickup in both the Whistler and Pemberton markets as a result of buyers looking for places for the upcoming snow season coupled with the pent-up demand stemming from all buyers waiting on the sidelines for interest rates to decrease. With the US Federal Bank cutting rates by half a percentage point in September, the Bank of Canada now has additional runway to continue with the consistent cutting. Consumer expectations that the rate cuts are to continue will naturally bring more buyers back to our real estate markets and likely shift the product mix sold.

We expect to see some continued volatility of the financial markets into the fall with the US election approaching in November, which we could see impact Whistler market sales. Closer to home, there is a provincial election October 19 which historically has generated it’s own share of unusual behaviour rooted in possible policy changes for the BC housing landscape.

*excluding parking stalls

Market Share

Whistler Real Estate Company agents represented 38% of the Whistler and Pemberton market year to date in 2024 and helped our clients achieve amazing outcomes.

Regulatory Notes

Foreign Buyers Ban

As previously noted, the Foreign Buyer Ban does not apply to the Whistler or Pemberton markets, nor does the Foreign Buyer Tax.

New Provincial Short-Term Rental Legislation

In May 2024, the BC government introduced the Short-Term Rentals Accommodation Act. While short-term rentals in Whistler are not impacted by the new regulation, there are rules that those renting their properties for this purpose need to follow (ie. obtaining and displaying your business license, and updating your listings on websites like Airbnb with your licensing information). The Village of Pemberton has chosen to opt-in to the new provincial legislation on short-term rentals, so reach out to your local Whistler Real Estate Company agent to find out what this means for your property.

Underused Housing Tax

The Underused Housing Tax (UHT) is an annual 1% tax on residential property owned by non-resident, non-Canadians that is deemed to be vacant or underused by the Canada Revenue Agency (CRA). There are situations, however, where the tax or reporting obligations could apply to Canadian citizens or residents, so it is important to understand whether you are an excluded or affected owner based on your specific situation. We recommend that you talk to your accountant about how it may impact you and your Whistler or Pemberton property.

Residential Tenancy Act Changes

On July 18, 2024 there were significant changes to the Residential Tenancy Act that those who own or are looking to sell or purchase tenant occupied properties should be aware of. Some of the key changes include:

- Mandatory landlord use of a new web portal to generate Notices to End Tenancy for personal or caretaker use

- Extended notice period

- The individual moving into the property must occupy it for at least 12 months

It is strongly advised that you seek legal advice to navigate these new regulations effectively if you plan to proceed with a transaction involving tenant-occupied property to ensure compliance with the new rules and ensuring understanding of rights and obligations of the parties involved. More information regarding these changes can be found on the BC Government Website.

Small-Scale Multi Unit Housing

The provincial government has introduced new housing legislation to update zoning rules to deliver more small-scale, multi-unit (SSMU) housing, with the intended objective of building more homes faster. In most municipalities of more than 5,000 people, these changes can allow for 3-4 units permitted on lots currently zoned for single-family or duplex use, depending on lot size, however strata bylaws may impact this. Get in touch with your local Whistler Real Estate Company agent to learn more about how this may impact your Whistler or Pemberton property or property of interest.