Real Estate Market Report: 2025 Q1

Let’s talk about the first quarter of 2025 in the Whistler and Pemberton real estate markets.

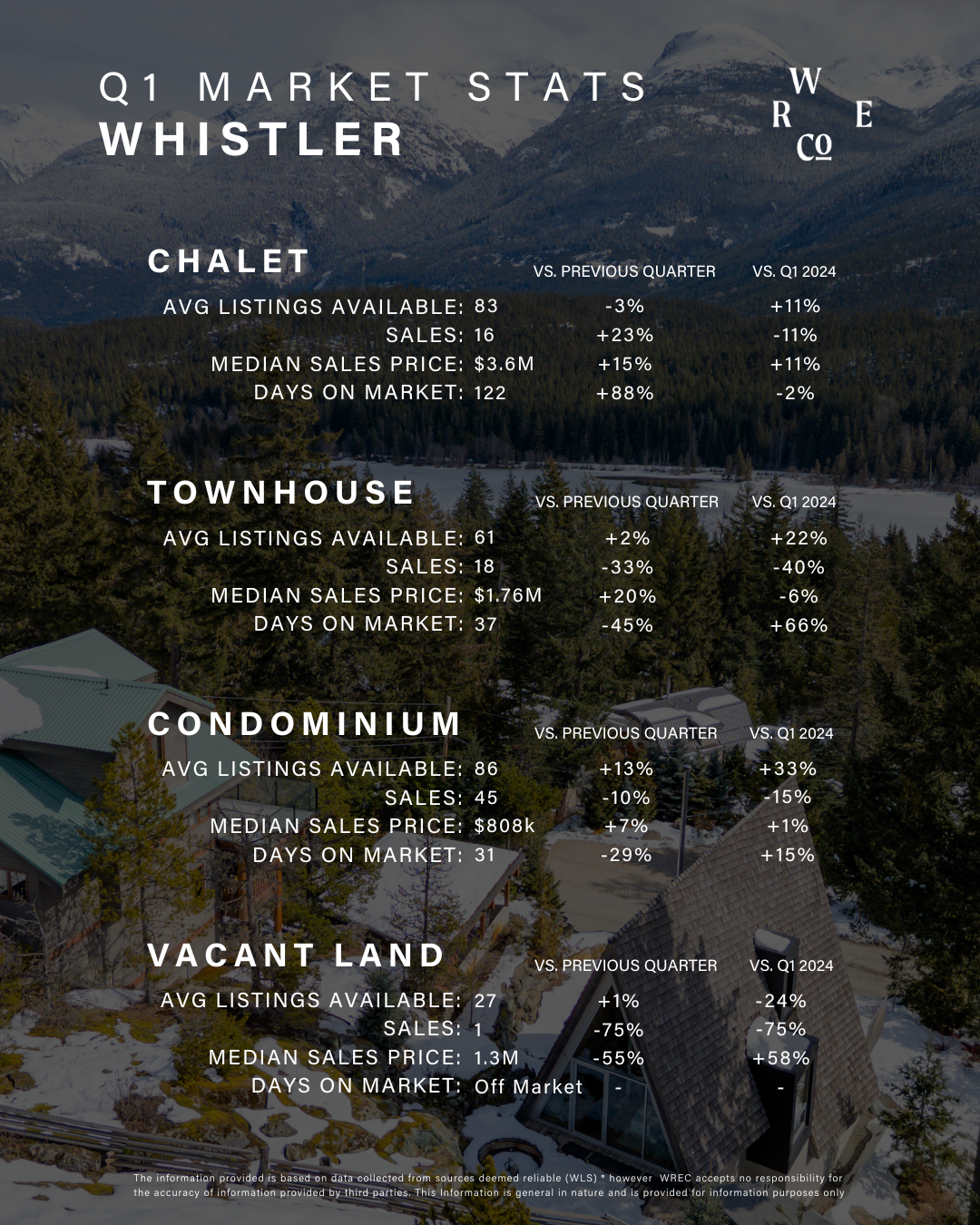

Whistler

The Whistler market is off to a slower start this year, with 106* sales in the quarter, down 23% from the 130* sales in Q1 last year. Despite slower sales, there was an uptick in the number of single-family homes sold in Q1 vs Q4 of last year. Inventory continued to rise through the quarter, with a total of 241* listings coming to the market. Overall inventory currently sits at 326* units, up 21% from the end of 2024 and 12% from the same time last year. The median sale price was up vs Q4 across the single family, townhome and condo categories. Median days on market for both townhomes and condos increased from Q1 of last year and decreased from Q4, to 37 and 31 days respectively. Days on market for single family homes was 122, which is on par with Q1 2024 and up from last quarter. Overall, the Whistler market is currently leaning in favour of buyers.

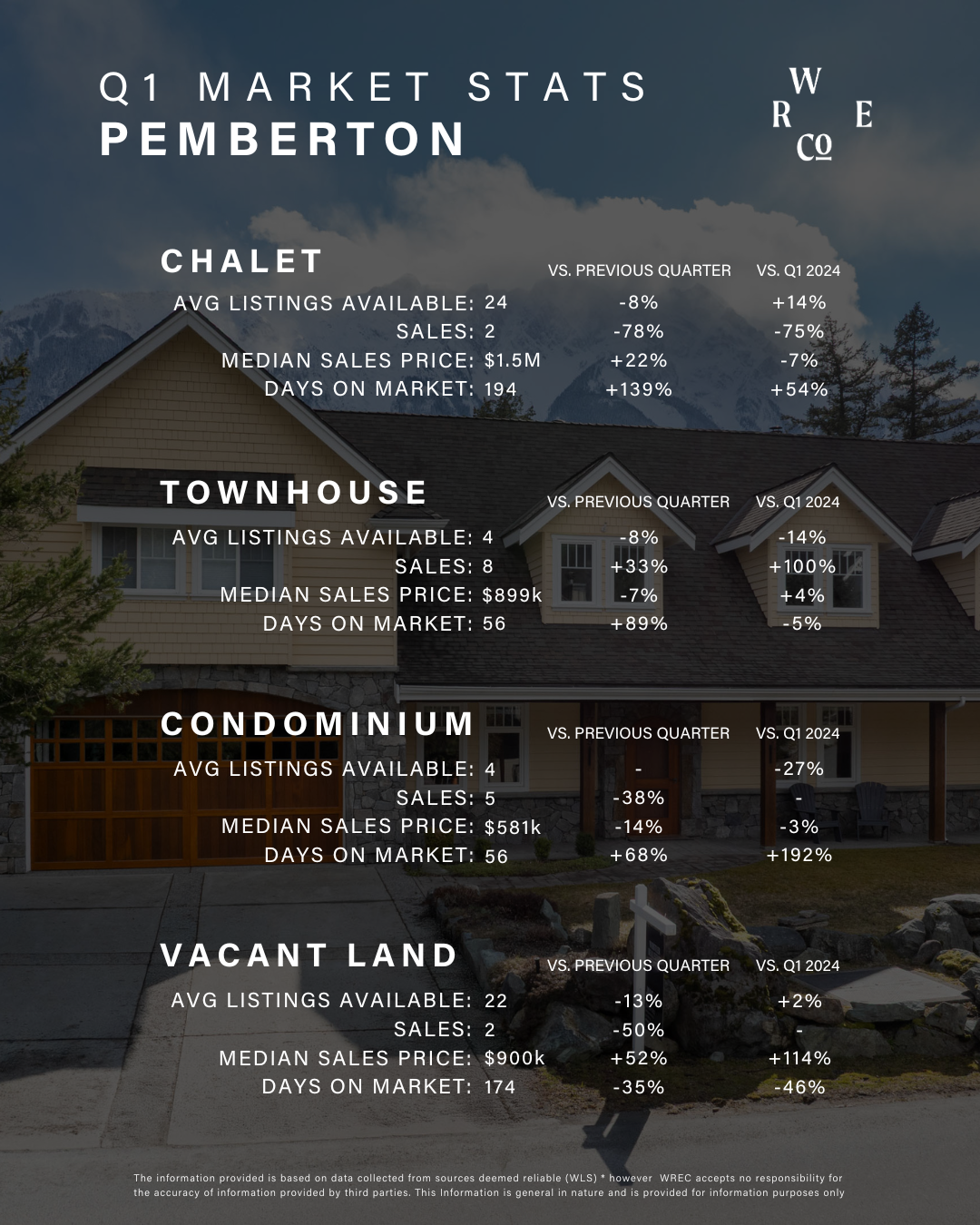

Pemberton

The Pemberton market so far this year has kept pace with 2024 sales, recording 20 sales in Q1. There was a notable decrease in single family home sales and a notable increase in townhome sales when compared to both last quarter and Q1 of last year. Inventory increased slightly throughout the quarter, with 62* units currently on the market and 41* when excluding vacant land. Overall inventory levels are down 15% from the same time last year and up 15% from the end of 2024. The median price point across all categories remained relatively stable compared to the same quarter of last year. Inventory sat on the market slightly longer in Q1 vs last quarter with days to sell increasing for single family homes, townhomes and condos. Overall, the Pemberton market is also leaning in favour of buyers, although inventory does remain a constant constraint.

From an overall market standpoint, we are experiencing both potential sellers and buyers “waiting and seeing” with the ever-evolving US tariffs, resulting market volatility and the Canadian Federal election at the end of the month. There have been policies proposed by parties as part of their platforms that could have significant impact on our real estate markets. So far we haven’t seen a typical start to the spring market, but we anticipate we will see an increase in activity later this spring after we have some more certainty on the political front. Despite the spring market delay, we are seeing well-priced quality product receive multiple offers and move quickly. If you’re thinking of selling, now’s the time to be strategic with your pricing – making a strong first impression can really set the tone for a successful sale. For buyers, take advantage of the current market while there is still a healthy amount of inventory to choose from. We anticipate the market will heat up come May as buying conditions, including inventory and mortgage rates, are the best we have seen in years.

*excluding parking stalls

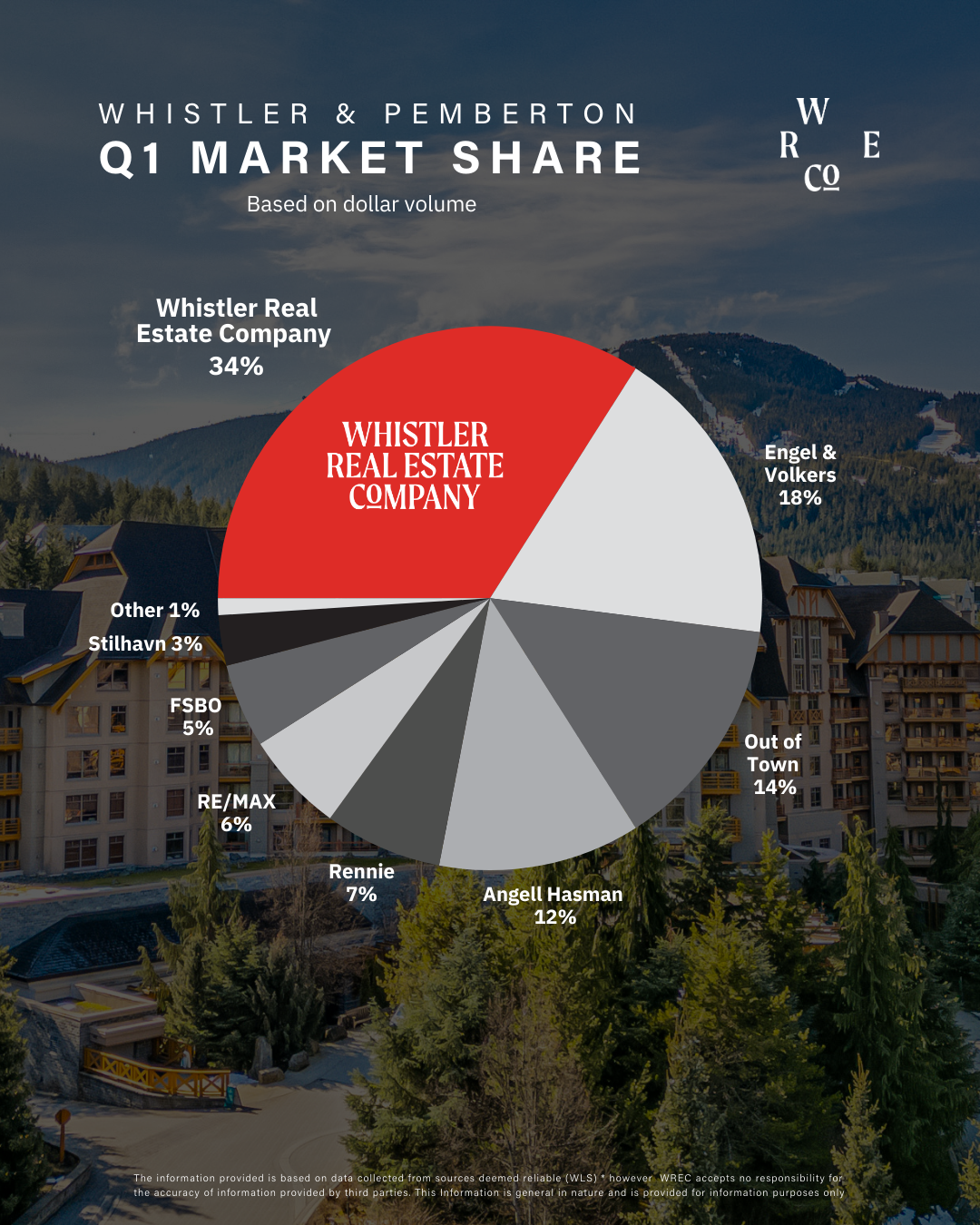

Market Share

Whistler Real Estate Company agents represented 34% of the Whistler and Pemberton market in the first quarter of 2025 and helped our clients achieve amazing outcomes.

Regulatory Notes

Foreign Buyers Ban

As previously noted, the Foreign Buyer Ban does not apply to the Whistler or Pemberton markets, nor does the Foreign Buyer Tax.

New Provincial Short-Term Rental Legislation

In May 2024, the BC government introduced the Short-Term Rentals Accommodation Act. While short-term rentals in Whistler are not impacted by the new regulation, there are rules that those renting their properties for this purpose need to follow (ie. obtaining and displaying your business license, and updating your listings on websites like Airbnb with your licensing information). The Village of Pemberton has chosen to opt-in to the new provincial legislation on short-term rentals, so reach out to your local Whistler Real Estate Company agent to find out what this means for your property.

Underused Housing Tax

The Underused Housing Tax (UHT) is an annual 1% tax on residential property owned by non-resident, non-Canadians that is deemed to be vacant or underused by the Canada Revenue Agency (CRA). There are situations, however, where the tax or reporting obligations could apply to Canadian citizens or residents, so it is important to understand whether you are an excluded or affected owner based on your specific situation. We recommend that you talk to your accountant about how it may impact you and your Whistler or Pemberton property.

Residential Tenancy Act Changes

On July 18, 2024 there were significant changes to the Residential Tenancy Act that those who own or are looking to sell or purchase tenant occupied properties should be aware of. Some of the key changes include:

- Mandatory landlord use of a new web portal to generate Notices to End Tenancy for personal or caretaker use

- Extended notice period

- The individual moving into the property must occupy it for at least 12 months

It is strongly advised that you seek legal advice to navigate these new regulations effectively if you plan to proceed with a transaction involving tenant-occupied property to ensure compliance with the new rules and ensuring understanding of rights and obligations of the parties involved. More information regarding these changes can be found on the BC Government Website.

Small-Scale Multi Unit Housing

The provincial government has introduced new housing legislation to update zoning rules to deliver more small-scale, multi-unit (SSMU) housing, with the intended objective of building more homes faster. In most municipalities of more than 5,000 people, these changes can allow for 3-4 units permitted on lots currently zoned for single-family or duplex use, depending on lot size, however strata bylaws may impact this. Get in touch with your local Whistler Real Estate Company agent to learn more about how this may impact your Whistler or Pemberton property or property of interest.

Capital Gains Inclusion Rate

The Canadian government had initially proposed an increase in the capital gains inclusion rate, which would have raised the taxable portion of capital gains from 50% to 66.7% for individuals, corporations, and trusts with gains exceeding $250,000. However, in March 2025, the Government of Canada announced the cancellation of the proposed hike, maintaining the current inclusion rate. This decision reflects the government’s commitment to fostering a stable and favourable environment for investment and economic growth.