Real Estate Market Report: 2025 Q3

Let’s talk about the third quarter of 2025 in the Whistler and Pemberton real estate markets.

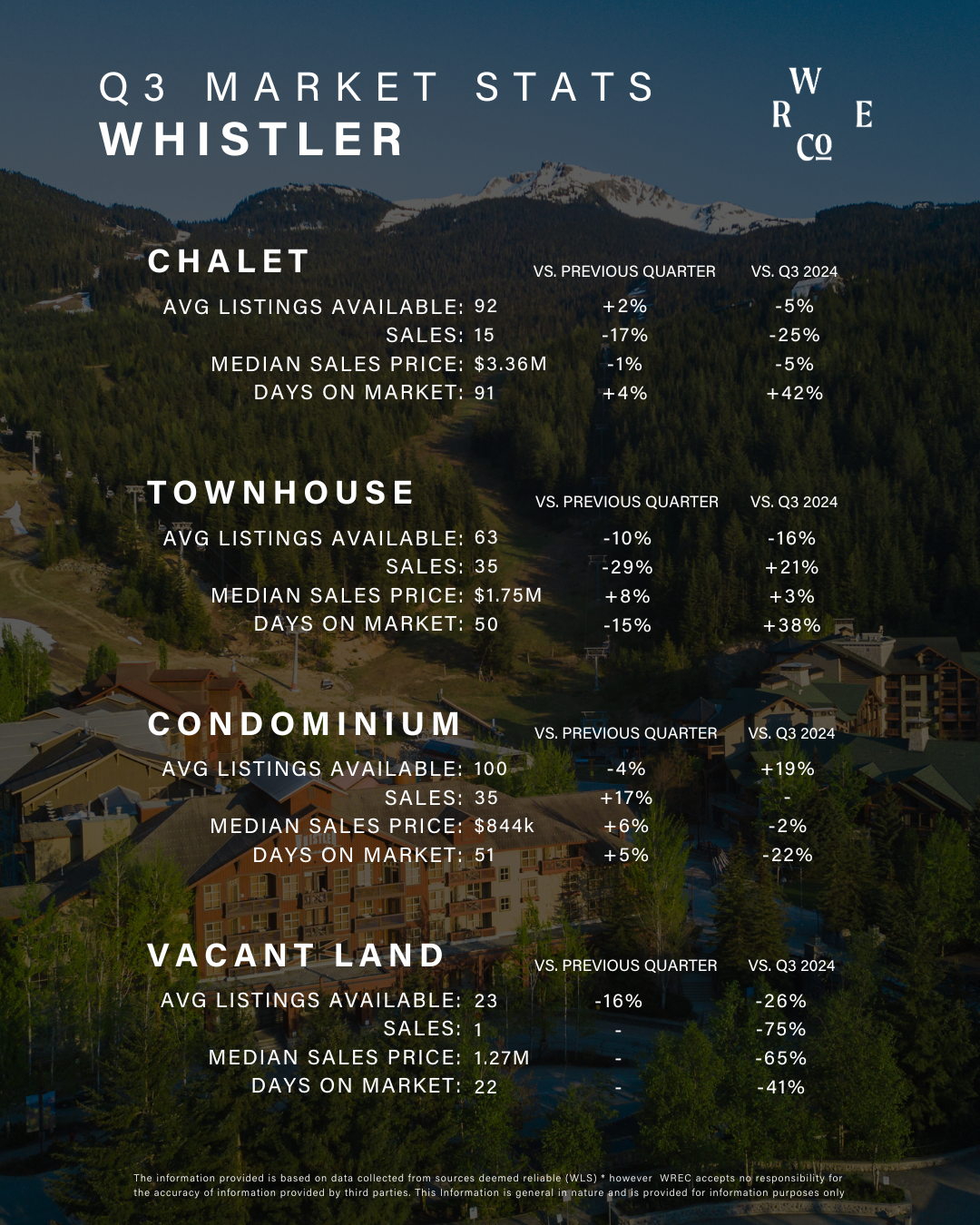

Whistler

Sales activity in Whistler remained slow over the summer, with a total of 106* transactions recorded in Q3. This represents a 9% drop from Q2 and a modest 3% decline compared to the same quarter last year. Despite the slower pace, prices held stable across property types, including single-family homes, townhomes, and condos, when compared year over year. Overall inventory remained fairly consistent throughout the quarter and currently sits at 320* units, about 4% lower than this time last year. Despite total inventory across all product types remaining relatively consistent, there were different and notable trends within specific product categories – townhome inventory has declined by 22% year over year, while condo inventory is up 32% from last year. Within the condo market, Phase 2 (hotel-style) properties have seen inventory levels nearly double compared to last year, while Phase 1 (nightly rental) units have experienced a 20% increase. In terms of buyer origin, year-to-date data shows 86% of buyers are from B.C., slightly higher than the historical average in the low 80s, with an additional 8% of buyers coming from the U.S. The luxury segment remains active, with nine sales over $4 million in Q3. Of those, four sold for more than $5 million, including a top sale of $12.65 million. Overall, Q3 market conditions in Whistler were relatively balanced.

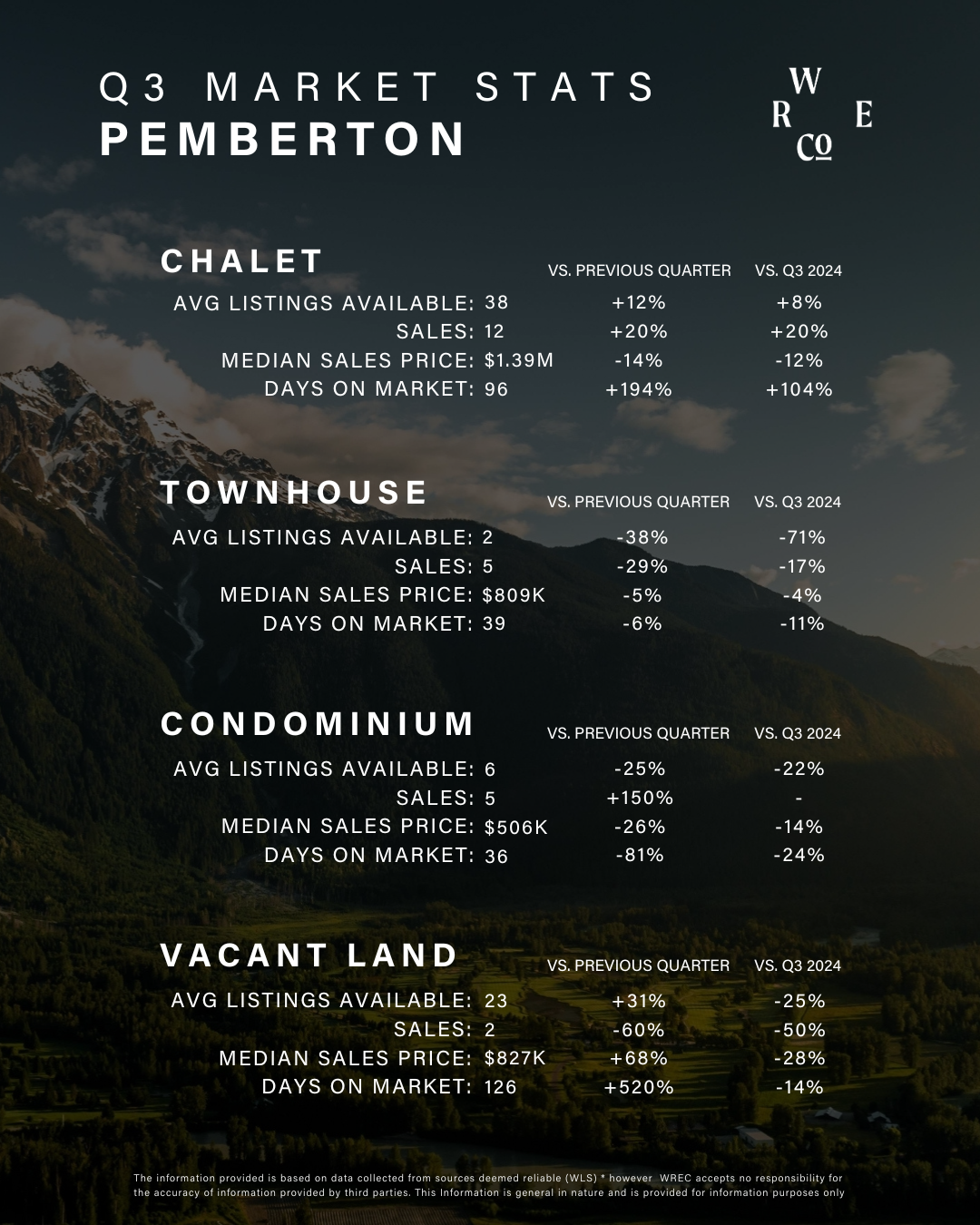

Pemberton

The Pemberton market experienced a slowdown in Q3. July recorded the highest monthly sales volume of the year so far, followed by an average August and a notably quiet September, which marked the lowest monthly total in 2025 to date. The quarter ended with 26* total sales, slightly ahead of Q2 but down three transactions compared to Q3 2024. Current market inventory sits at 82* units, or 57* units when excluding vacant land. This is the highest inventory level seen since September of last year. Median sale prices softened slightly across all categories. Single-family homes were down 12%, townhomes 4%, and condos 14% year over year. Despite this, the luxury market remained active, with a top sale in the quarter of $2.45 million, marking the fourth property to sell over $2 million in Pemberton this year. Buyer origin remains consistent with past trends. Approximately 82% of buyers are from Pemberton, Whistler, or Squamish, with 7% from Vancouver and nearly 6% from other Canadian or international locations. At present, the Pemberton market is leaning in favor of buyers.

In mid-September, the Bank of Canada reduced interest rates for the first time since March. There is growing speculation that another cut may follow before the end of the year, depending on inflation and broader economic conditions. This shift is beginning to restore some of the buyer confidence that has been lacking in recent months. As of the end of Q3, Whistler is trailing last year’s sales pace by 14%, and Pemberton by 11%. However, we expect this gap to narrow in Q4, with overall 2025 sales likely to near match 2024 totals in both markets. We anticipate a typically active fall in Whistler as buyers look to secure properties ahead of ski season. In Pemberton, we expect to see continued steady performance, consistent with the trends observed throughout 2025. Whistler and Pemberton are distinct real estate markets that don’t always follow regional trends. For market insight that’s accurate and relevant to your goals, rely on the expertise of your local agent to guide you in the right direction.

*excluding parking stalls

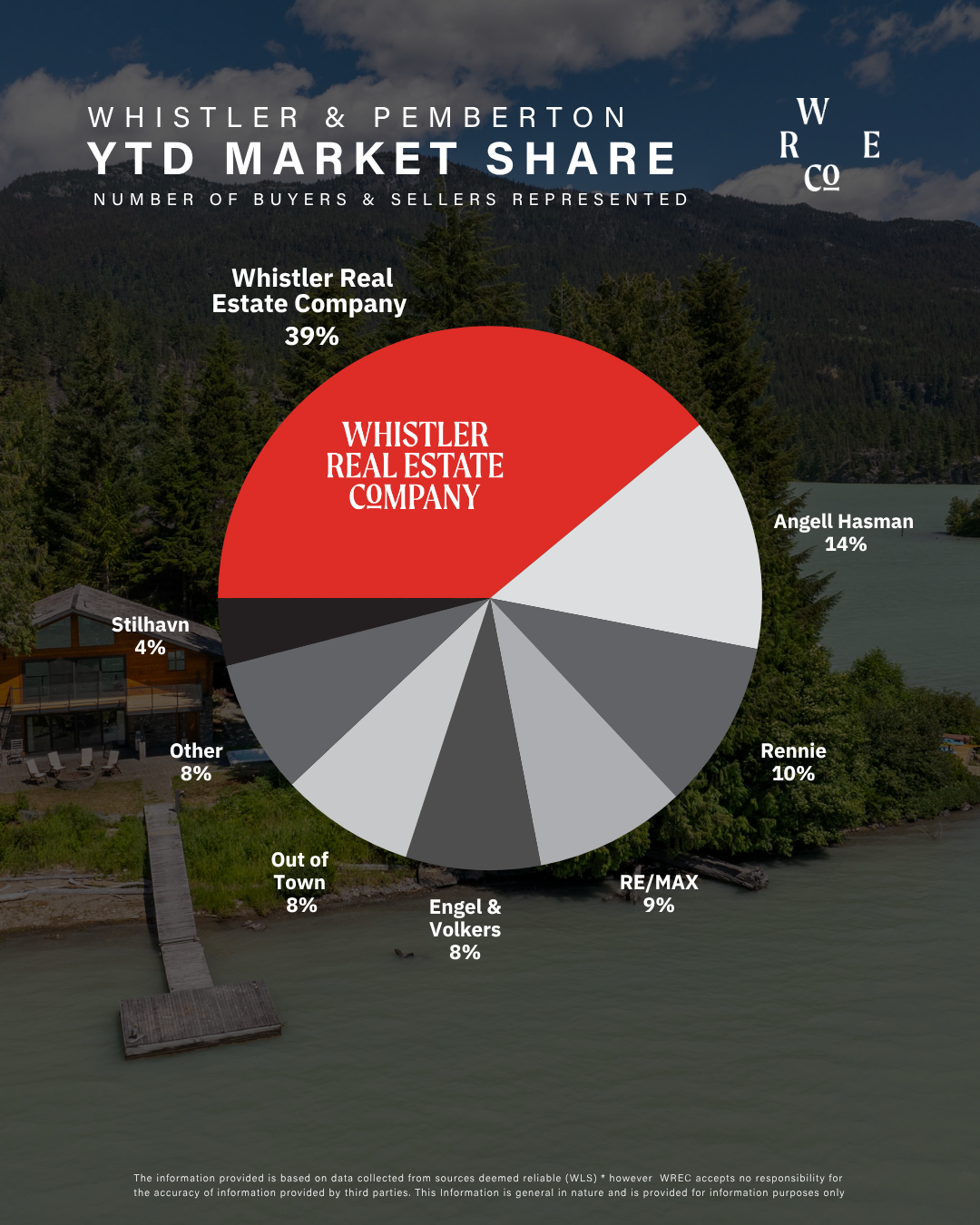

Market Share

Whistler Real Estate Company agents represented 39% of the Whistler and Pemberton market year to date in 2025 and helped our clients achieve amazing outcomes.

Regulatory Notes

Foreign Buyers Ban

As previously noted, the Foreign Buyer Ban does not apply to the Whistler or Pemberton markets, nor does the Foreign Buyer Tax.

Underused Housing Tax

The Underused Housing Tax (UHT) is an annual 1% tax on residential property owned by non-resident, non-Canadians that is deemed to be vacant or underused by the Canada Revenue Agency (CRA). There are situations, however, where the tax or reporting obligations could apply to Canadian citizens or residents, so it is important to understand whether you are an excluded or affected owner based on your specific situation. We recommend that you talk to your accountant about how it may impact you and your Whistler or Pemberton property.

Small-Scale Multi Unit Housing

The provincial government has introduced new housing legislation to update zoning rules to deliver more small-scale, multi-unit (SSMU) housing, with the intended objective of building more homes faster. In most municipalities of more than 5,000 people, these changes can allow for 3-4 units permitted on lots currently zoned for single-family or duplex use, depending on lot size, however strata bylaws may impact this. Get in touch with your local Whistler Real Estate Company agent to learn more about how this may impact your Whistler or Pemberton property or property of interest.

BC Home Flipping Tax

Effective January 1, 2025, British Columbia’s new home-flipping tax aims to limit short-term real estate practices and improve housing affordability. The tax applies to properties sold within two years of purchase, with a 20% rate on net taxable income for sales within the first year, and decreasing tax rates for sales between one and two years. Exemptions are subject to specific conditions and filing requirements. For more information, get in touch with your local Whistler Real Estate Company agent to better understand how this affects your property.