Whistler Real Estate Market Report: First Quarter, 2022

Let’s talk about real estate activity in Whistler during the first quarter of 2022.

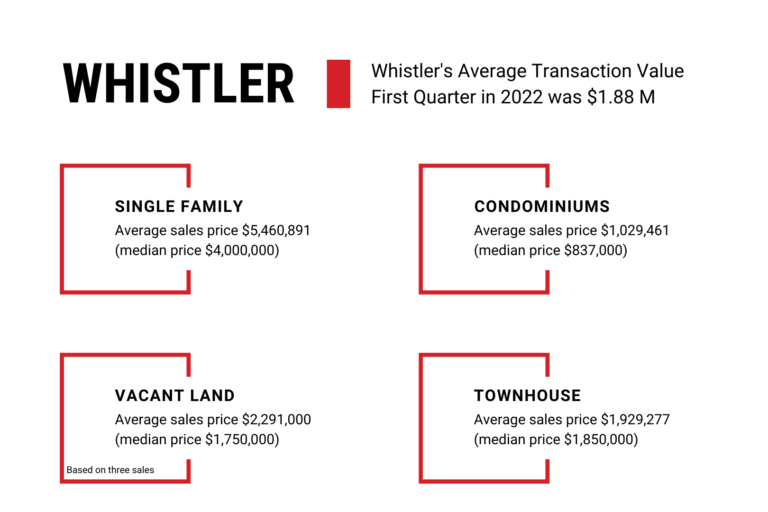

When compared to the first quarter of 2021, the pace of unit sales has slowed substantially from 108 ends per month, hitting a high of 114 in March 2021. However, at 71 ends per month, the market still outpaced the long-term average of 65 units per month. The average sales price of units in Whistler has continued to climb, even as the pace of sales has slowed. The average transaction value YTD is $1.88M, which is a notable increase of about 20% from the average transaction value of $1.57M reached at the end of 2021.

Market Report Video

Looking Forward

Inventory – The Whistler market inventory has slowly improved from the historical low reached in December 2021, but the market is still constrained by a lack of supply. We expect that to continue throughout the second quarter of 2021.

Economic Policy and Geopolitical Influence – At this point, the Whistler market has not been affected by the March 2022 interest rate increase, the first increase from the Bank of Canada since 2018. Additional interest rate hikes are likely imminent as the year progresses in an attempt to curb inflation, but we expect the impact on the Whistler market to be minimal at most. The foreign buyer ban announced on April 7, 2022, as part of the Federal budget will exclude recreational properties. The impact, if any, on the Whistler market will be dictated by the much-anticipated definition of recreational properties. We recommend keeping in touch with your local Whistler Real Estate agent to learn more as this regulation develops. Given the vast majority of Whistler, buyers originate from British Columbia’s lower mainland, however, we don’t anticipate this will have an impact on the pace of sales or prices in the Whistler market. The current geopolitical conflict and resulting uncertainty also haven’t seemed to have an impact on the market. We will see if that continues.